简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX's Expert Advisors (EA) Help You Trade Systematically

Abstract:Expert Advisors (EA) trading is an automated system that utilizes computer programming to help traders in achieving systematic profits and growth. In today’s article, we are introducing WikiFX’s EA that could help elevate your trading performance without you lifting a finger.

EA is the abbreviation of Expert Advisors, also known as Automated Trading System (ATS) software, which is a computer simulation based on the actual operation of the order submitted by the trader to carry out the entire process of automated trading. It is a software that is specially designed to automate quantitative trading strategies after their main logical parameters have been calculated into a computer system.

Here are some advantages of automated technical trading:

1. Specialization in buying and selling methods

The computer automatically implements the order submission process when it detects the programmed buying and selling concepts as well as trading signals that are transmitted through computers.

2. Eliminates psychological problems of human nature

The hardest thing about trading is mastering ones emotions and psychological aspects, typically fear, greed, hesitation, and ego when buying and selling in the financial markets.

3. Calculated trading system

As computer software operates based on programming, it executes strictly with calculated profitability, risk control standards, and procedural processes.

4. Saves time and effort

Trading is a skill that takes a lot of effort and time to master but not everyone has the time to study the currency markets, and go through the ups and downs of the trading journey which could take years. Thus, this is where technology such as EA trading comes in handy.

WikiFX VPS‘s Expert Advisors that you could simply download into your broker’s MT4 trading platform and they execute trades automatically without any manual intervention for 24 hours, 7 days a week.

There are many EAs in the forex industry and some are sold with really high price tags. At WikiFX, all of our EAs cost as low as a cup of coffee, and they have all been through extensive backtesting to prove their ability to withstand different market conditions.

For more information, log on to the WikiFX EA Shop here: https://cloud.wikifx.com/en/eashop.html.

Alternatively, on the WikiFX mobile app, click on “EA”.

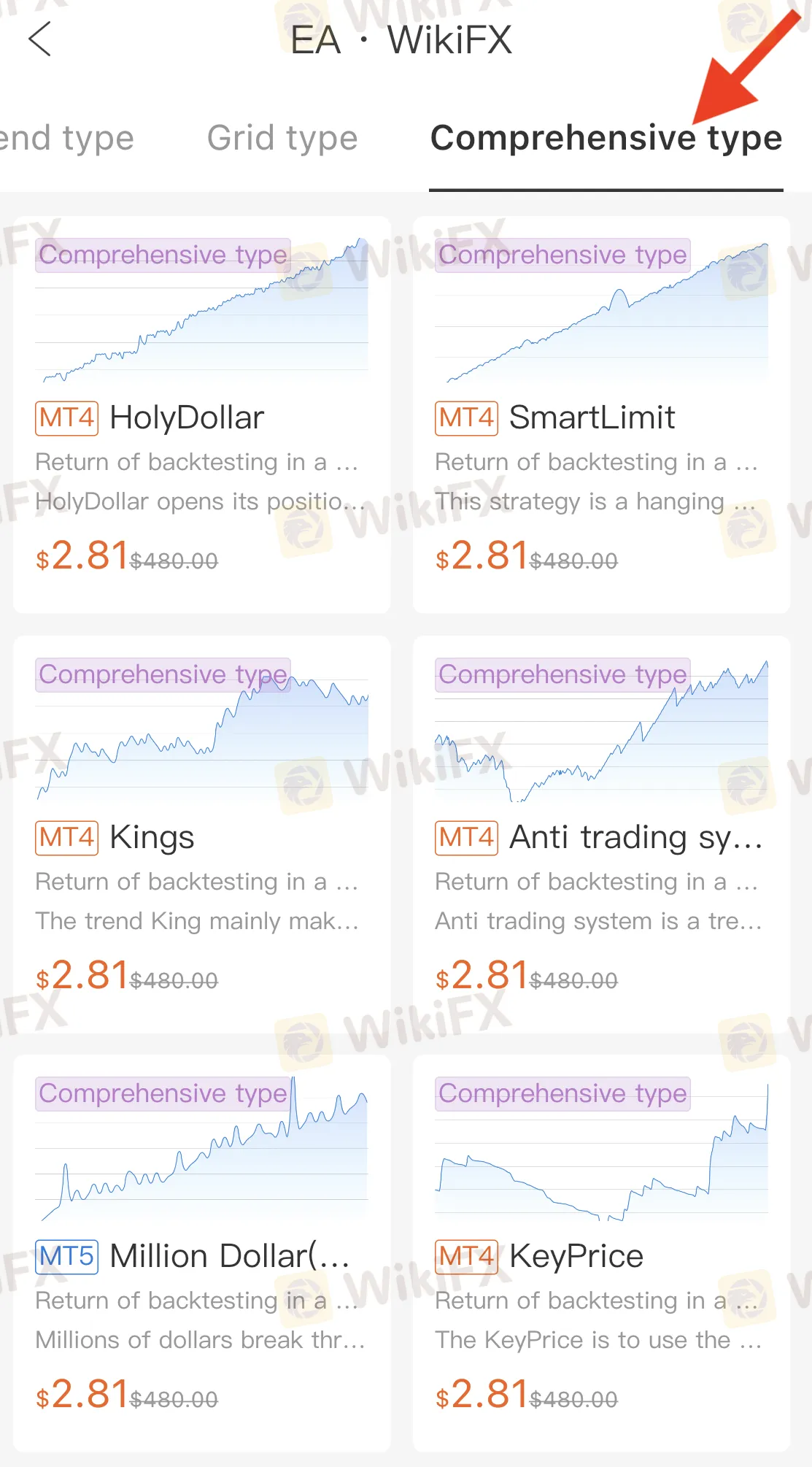

WikiFXs EA shop offers different categories of EA, namely Tools, Martin, Shock, Trend type, Grid type, and Comprehensive type.

Let us select one EA randomly as an example.

The EA we are using as an example is named Metaverse. From here you could see a detailed introduction about this particular EA including the rate of return during the backtesting period, how long it was being backtested before its official launch, how much profit/loss it had generated, etc.

From this screenshot above, you could see that this Metaverse EA has brought upon a net profit of $19.8K on a starting capital of $10K when used on trading gold.

Complete information of this EA is also available on the page for a deeper insight.

You could also download the test report to see a detailed breakdown of all the trading transactions that were carried out with this EA.

Using EA is an excellent and efficient way to trade but it is important to find an EA that works in line with your trading strategy and risk appetite. With a myriad of EA being offered on WikiFX VPSs EA page, we are certain that you could find a suitable one after doing your due diligence.

Whether you are trading with an EA or trading manually on your own, it is always wise to invest time and effort into conducting research and carrying out backtests with a demo account before trading your hard-earned money. That is also why WikiFXs EA is offered at such reasonable pricing so everyone could work towards a solid automated forex trading system at ease.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Why Do Malaysians Keep Falling for Money Games?

Malaysia has seen a persistent rise in money game schemes, luring thousands of unsuspecting investors with promises of high returns and minimal risk. These schemes operate under various disguises, from investment clubs to digital asset platforms, yet they all follow the same fundamental principle—new investors fund the profits of earlier participants. Once the cycle collapses, the majority are left with devastating losses. Despite repeated warnings and high-profile cases, many Malaysians continue to fall victim. What drives this phenomenon?

Axi Review 2025: How to Open An Account & Withdraw Money ?

Launched in 2008, Axi (formerly Axitrader), is an Australia-registered online forex broker that has gained solid development these years. Globally and heavily regulated, the Axi brand has several entities operating under different jurisdictions, including ASIC in Australia, FCA in the UK, CYSEC in Cyprus, FMA in New Zealand, and DFSA in the United Arab Emirates. Axi gives investors the opportunity to enter some popular markets with small budgets, including Forex, Metals, Indices, Commodities, Cryptocurrency, particularly IPOs, using its advanced software—the Axi Trading platform (newly launched), Copy Trading App, MT4, MT4 Webtrader . With no cost during account setup, traders can choose from 3 tailored live accounts in addition to a demo account. Among many forex brokers, Axi stands out due to its user-friendly interface, which allows for quick and simple account opening and withdrawals.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

IMF Warns Japan of Spillover Risks from Global Market Volatility

Currency Calculator