简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a PIP? - WikiFX Forex Trading Concepts

Abstract:A point-in-percentage, or pip, is a standardized unit used to quantify tiny changes in currency pair pricing. Even modest market swings may offer potentially profitable trade settings as well as possible losses. Therefore, the tiny pip increment guarantees that constant trading chances are accessible. Furthermore, the pip dramatically improves order accuracy and spread specificity. All of our platforms automatically count pips to calculate the profit or loss of your transaction.

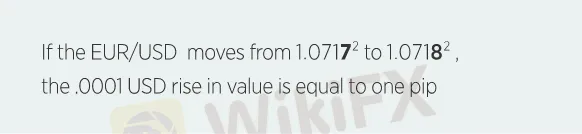

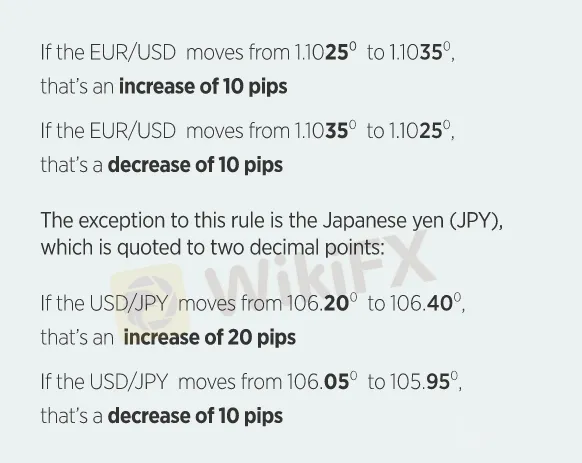

Currency values are generally reported in pips or percentages in points since they vary in such small increments. A pip is often defined as the fourth decimal point of a price, which is equivalent to 1/100th of one percent.

Pips in Fractions

The fractional pip, which is 1/10th of a pip, is represented by the superscript number at the end of each price. The fractional pip indicates price fluctuations much more precisely.

Pips in Action

Determining the worth of a pip

A pip's value fluctuates depending on the currency pairings you trade as well as which currency is the base currency and which currency is the counter currency.

Using the same example, you purchase 10,000 euros at 1.10550 versus the US dollar (EUR/USD) and earn $1 for every pip rise in your favor. You would profit $10 if you sold at 1.10650 (a 10-pip gain).

If all of the above conditions were met, but you sold at 1.10450 (a ten-pip drop), you would lose $10.

Consider the USD/JPY pair, in which the US dollar serves as the base currency.

The USD/JPY exchange rate determines the value of one pip in this situation.

So, using the same example, you purchase 10,000 US dollars at 106.20 yen and make $0.94 for every pip rise in your favor. You would profit $18.80 if you sold at 106.40 (a 20-pip gain).

If the aforementioned conditions were the same but you sold at 106.00 (a 20-pip decline), you would lose $18.80.

More WikiFX educational articles may be found at the following address: https://www.wikifx.com/en/education/education.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CySEC Issues Investor Warning on 9 Unlicensed Platforms

CySEC warns investors of growing risks from unlicensed financial platforms after identifying 9 more websites violating local regulations.

Consob Orders Blackout of 7 Abusive Financial and Crypto Websites

Consob has blocked seven websites allegedly offering financial and crypto services without authorisation, bringing the total number of blackouts to 1,275 since 2019.

Oil Prices Plunge Again: What's Going On in the Market?

Prices tumble to a 4-year low, shaking investor confidence. What’s next for the market?

Gold Prices Climb Back to $3000: What Should Investors Watch For?

As market uncertainty rises, gold climbs above $3000 again. It's time for investors to rethink their strategies.

WikiFX Broker

Latest News

Shocking! Oil Prices Plunge Below $60

BI Alerts Filipinos: Telegram, Facebook Used for Trafficking Scams

AUD/USD Hits New Lows as Panic Selling Unfolds Amid Robust U.S. Jobs Report

FCA Released New List of Unauthorized Brokers

How to protect your money during Black Monday

Wall Street Funded Establishes Broker in St. Lucia to Reintroduce MetaTrader 5

Think You’re Too Smart to Fall for an Investment Scam?!

ASIC Shuts Down 95 Scam Companies in Major Crackdown on Fraud

Tether Eyes U.S. Stablecoin Launch Amid Crypto Regulation Shifts

CMC Markets Elevates Trading with TradingView Integration

Currency Calculator