简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Checking FX Brokers’ FCA Licenses in A Few Seconds

Abstract:As forex trading becomes more popular, more fraudulent brokers are beginning to lurk in this profitable market. Before one aims to make profits from the forex market, it is important to have the skills to identify fraudulent brokers. In today’s article, WikiFX will show you how to verify a broker’s regulatory status in just a few clicks.

There are 6 main regulatory bodies in the world that safeguard the forex industry, namely:

• United Kingdom: The United Kingdom Financial Services Authority

• United States: National Futures Association (NFA) and the Commodity Futures Trading Commission (CETC)

• Australia: Australian Securities and Investments Commission (ASIC)

• Switzerland: Swiss Federal Banking Commission (SFBC)

• Germany: German Federal Financial Supervisory Authority (BaFIN)

• France: French Financial Markets Authority (AMF)

In this article, to make it easier to understand and straightforward, we will focus on the UKs Financial Conduct Authority (FCA), which is formerly known as the UK Financial Services Authority (FSA).

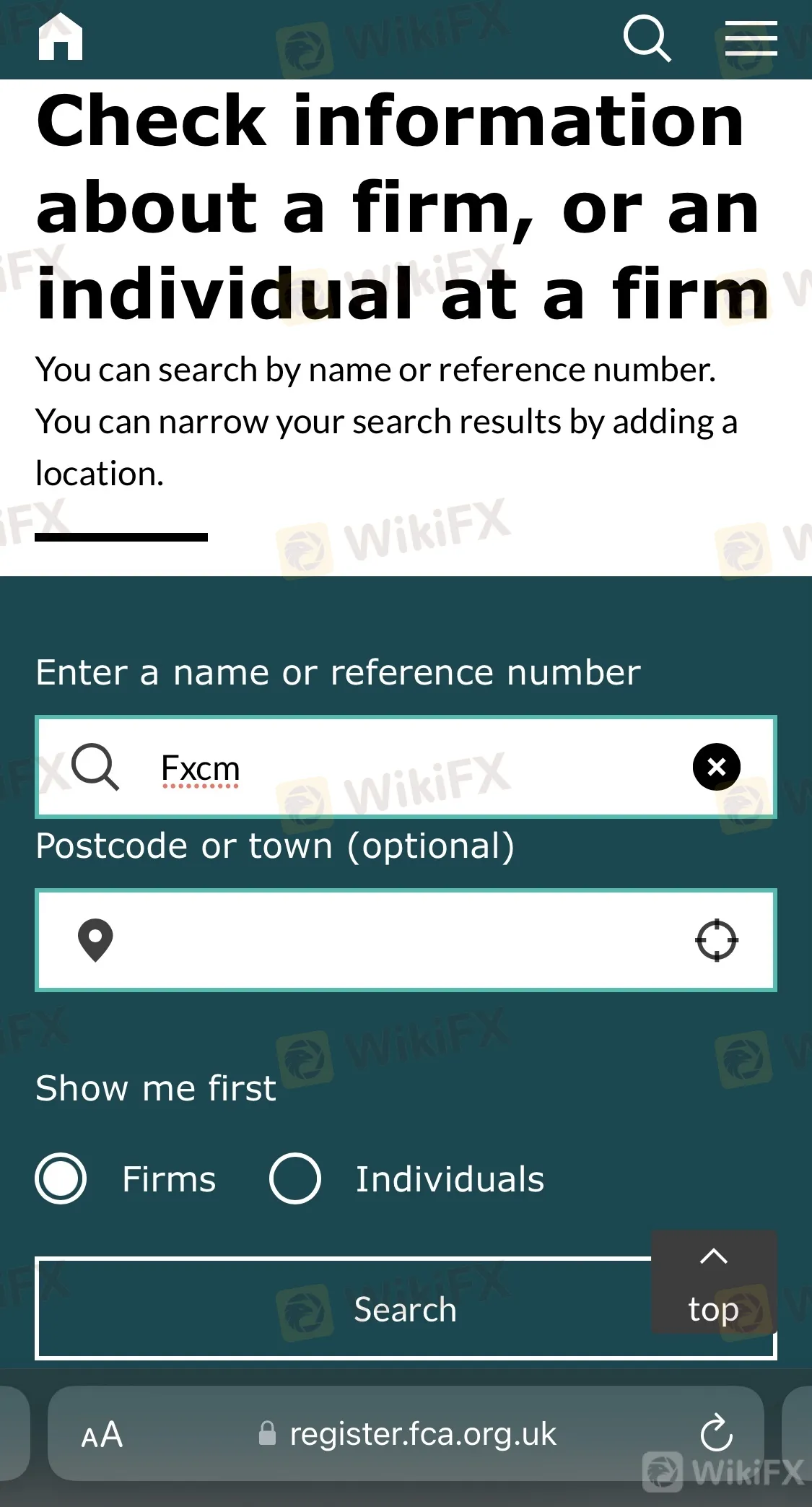

Firstly, log on to https://register.fca.org.uk/ which is the database of all registered entities under the regulation of the UKs FCA.

In this article, we will be using a forex broker named ‘FXCM’ as an example.

It is important to take note of the reference number of the entity in question.

From here, it is evident that FXCM is an authorized forex broker that is operating under the regulation of the UK FCA. With its reference number, we can easily cross-check its information.

For example, on FXCMs WikiFX profile, click on its FCA license.

Furthermore, from FXCM‘s WikiFX profile, we can also see that this forex broker has achieved a fairly high WikiFX score, which means it has been evaluated as a reliable forex broker. In addition, its registered business premise was also verified by WikiFX’s field survey team.

From all this available information, it can be concluded that FXCM is a reliable broker that traders can trust.

On the other hand, if a trader would like to find a forex broker that is under the regulation of the FCA but does not know where to begin searching, he can do this simply on the WikiFX free mobile app in just 2 steps:

With so many brokers available on the internet, it is always crucial for a trader to perform his due diligence to avoid falling into the traps of malicious forex brokers.

For more tips on what to look for when searching for the right forex broker, read this article here: https://www.wikifx.com/en/newsdetail/202206012274264618.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nigeria’s Oil and Gas Sector Gains Momentum

Nigeria’s oil and gas industry is experiencing a surge in investment, fueled by policy reforms and international collaboration, paving the way for continued energy expansion.

The Global Tariff War Escalates: Who Suffers the Most?

The global trade war is intensifying as countries continue to raise tariffs, aiming to protect their own economies while creating greater market uncertainty. In this tit-for-tat game, who is truly bearing the brunt?

Immediate Edge Review 2025: Is it safe?

Launched in 2019, Immediate Edge claims to be an automated cryptocurrency trading platform using AI technology for crypto trading services. The platform requires a minimum deposit of $250 to begin trading, which is relatively expensive for many investors. During its short operation, Immediate Edge failed to establish a positive reputation. The platform has undergone frequent domain changes and has repositioned itself as an intermediary connecting users with investment firms—a move that appears designed to obscure its actual operations. Immediate Edge restricts services to investors from the United States; it remains accessible to users in other regions.

BSP Restricting Offshore Forex Trades to Control Peso Volatility

BSP tightens rules on offshore forex trades, including NDFs, to reduce systemic risks and peso volatility. Stakeholders’ feedback due by March 26.

WikiFX Broker

Latest News

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

The ‘Boom-S’ Scam: How a Simple Click Led to RM46,534 in Losses

Royal Forex’s CySEC License Revoked: Can It Still Operate Legally?

Trump vs. Powell: The Showdown That Will Shape Global Markets

Currency Calculator