简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The victim is unable to withdraw money both capital and profit after investing in UEZ Markets

Abstract:This article sheds light on the plight of an investor who finds themselves unable to withdraw both their capital and profits after investing in UEZ Markets.

About UEZ Markets

UEZ Markets is a forex broker that was founded in 2018. It is regulated by the Australia Securities & Investment Commission (ASIC, No. 001300519). UEZ Markets offers a variety of trading instruments, including Forex, Metals, Energies, Crypto, and Indices through the MT5 trading platform. This broker does not hold a legitimate license, we could not consider this broker a reliable broker. Thus, we hope all traders understand the risk of investing in this broker.

The Case in Details

On March 27, 2023, The trader decided to invest $1000 with UEZ Markets, a broker promising consistent monthly profits ranging from 5-6% of the invested capital. The allure of such gains, coupled with the assurance of being able to withdraw both the profits and the initial investment, enticed the victim to take the leap. To legitimize their engagement, UEZ Markets issued investment certificates, labeling them as “Term Managed Account” (TMA), seemingly to establish an air of credibility around their services.

The Red Flag

As time progressed, the victim's investment reportedly yielded profits as promised. With a sense of accomplishment, the investor initiated a withdrawal request to access their accrued profits and capital. To their shock and dismay, UEZ Markets declined the withdrawal request, citing an inability to process the transaction. This red flag sparked concerns about the legitimacy and reliability of the broker, leaving the victim in a state of financial limbo.

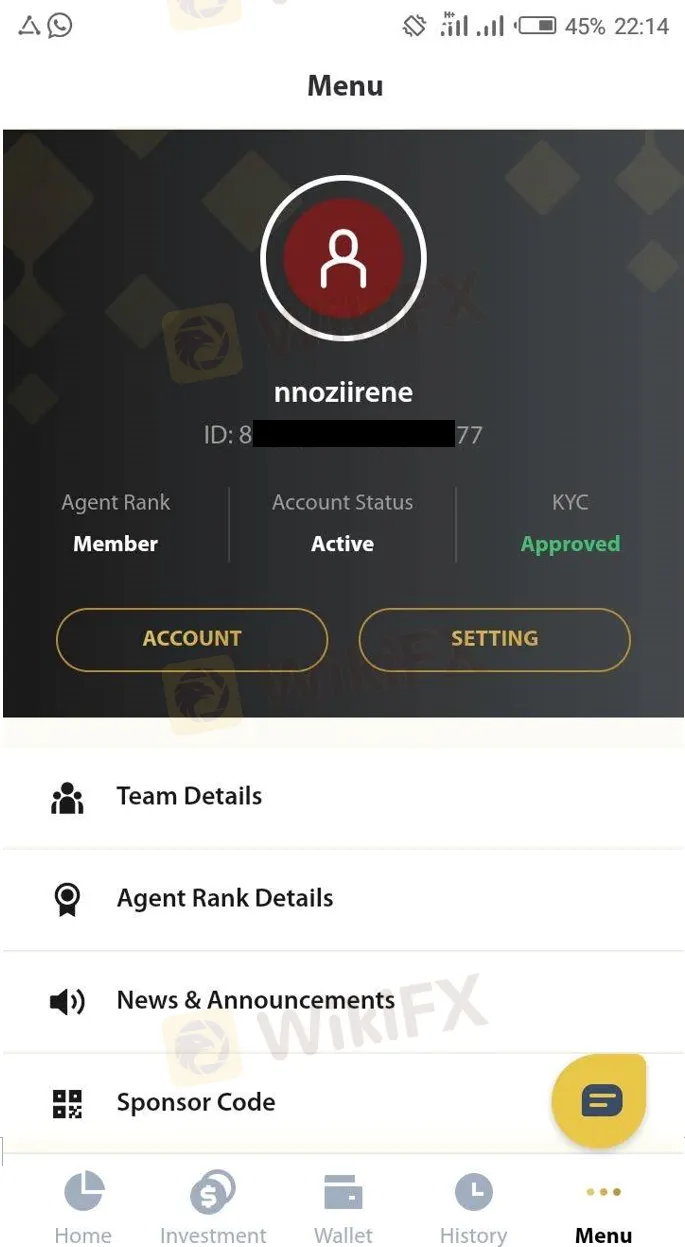

Faced with the predicament of being unable to withdraw both the profits and the invested capital, the victim turned to WikiFX for assistance. WikiFX, a platform that provides information and ratings about forex brokers, is often sought after by investors seeking clarity and redress. The victim's hope lies in WikiFX's ability to investigate the matter, potentially helping them recover their invested funds.

Conclusion

Investing is a double-edged sword; it can bring substantial returns, but it also carries risks. The tale of the victims unable to withdraw their capital and profits from UEZ Markets underscores the importance of research, due diligence, and cautious decision-making in the investment realm. It also highlights the necessity for robust regulatory frameworks to prevent instances of fraud and protect investors' rights. As the victim seeks assistance from platforms like WikiFX, the hope remains that they will find a solution to their ordeal and serve as a cautionary tale for others considering similar investment paths.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Why Your Forex Trades Are Always Losing

There is no guaranteed way to win in forex trading, but why do so many people still fail?

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Beware of Comments from the Fed's Number Two Official

Federal Reserve Vice Chairman Philip Jefferson's recent remarks have attracted widespread attention in the market.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Currency Calculator