简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Checkout the List of Most-Complained Brokers in August in India

Abstract:Wikifx reveals the list of the most complained brokers in August 2023 in India. Wikifx received numerous complaints from customers, highlighting their poor service and questionable practices against these brokers. It is important for investors to be aware of these brokers in order to make informed decisions and protect their hard-earned money. Check out the list of Fraudulent brokers and stay safe.

Wikifx reveals the list of the most complained brokers in August 2023 in India. Wikifx received numerous complaints from customers, highlighting their poor service and questionable practices against these brokers. It is important for investors to be aware of these brokers in order to make informed decisions and protect their hard-earned money. Check out the list of Fraudulent brokers and stay safe.

CAPPMOREFX is a forex broker that claims to offer a wide range of trading services and investment opportunities. According to its website, the company provides access to various financial markets, including forex, stocks, commodities, and cryptocurrencies. It also boasts competitive spreads, flexible leverage options, and advanced trading tools.

Elland Road Capital is a regulated financial service corporate based in South Africa. They offer MT4/5 white label services and cater to regional brokers. However, the broker has been associated with suspicious activities and high potential risk, as indicated by multiple complaints and warnings from WikiFX.

Fine Capitals is a UK-registered online forex broker, established in 2022, boasting of offering clients access to massive financial markets such as forex, spot metals, energies and indices. Fine Capitals is the trading name of Fine Capital Ltd, a company incorporated in the United Kingdom as limited liability company number 13120655, with its registered office at 20-22 Wenlock Road, London, n17gu, England.

BlaFX is a trading platform that prioritizes regulatory compliance to provide a secure and trustworthy environment for and holds a Retail Forex License from the Vanuatu Financial Services Commission (VFSC). These regulatory licenses validate BlaFX's adherence to stringent regulations and industry standards, ensuring client protection, market integrity, and adherence to financial guidelines.

Hiltonmetafx is a newly established trading platform based in the Philippines. They claim to offer users access to over 2100 trading products, with leverage of up to 200. However, it's important to note that this broker is not regulated by any valid regulatory authority.

WaveFX is a corrupt investment scheme disguised as a Forex broker. It advertises trading in a wide range of assets, including forex and various CFDs, but in fact, doesnt facilitate any trading activity. And of course, it operates without any authorization Read the review if you want to know more about this fraudulent brokerage.

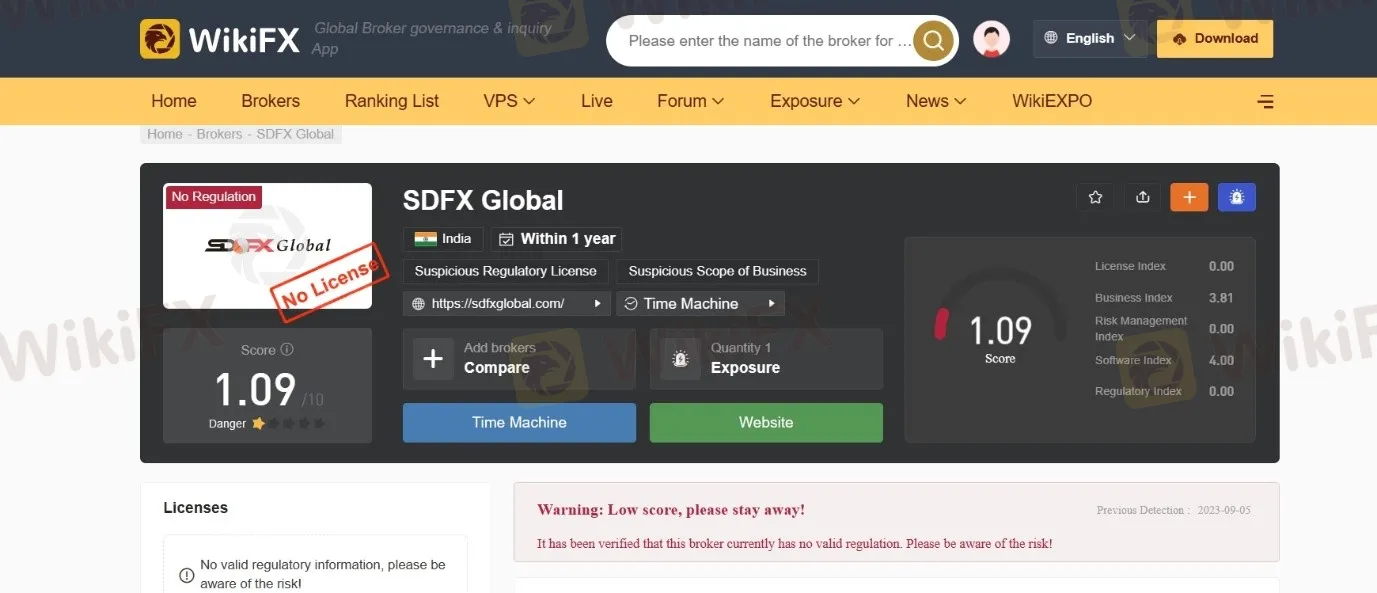

SDFX Global is an unregulated brokerage firm based in India, offering forex trading services without any specific regulatory oversight. It provides access to market instruments for forex trading, accepts deposits and withdrawals exclusively through bank transfers, and offers customer service through various communication channels.

Live-forex trade Regulation & Licensing warning: live-forex trade Limited with registration number 8424819-1 is a company registered under the Laws of USA and is licensed by the Financial Services Authority (FSA) of USA with a Securities Dealer License No: SD037.

Wikifx encourages Investors to thoroughly research brokers and consider customer reviews before making any investment decisions. By staying informed and vigilant, investors can download WikiFX app on their smartphone to stay updated with the latest news of Forex To learn more about the security and reliability of your chosen brokers, visit www.wikifx.com or download our free app from Google Play or app store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Deriv Review 2025: A Growing Force in Online Trading

As one of the rapidly developing online trading platforms in recent years, Deriv has gradually carved out a place in the global market.

Vantage Foundation has partnered with Hands of Hope Laos

Vantage Foundation has partnered with Hands of Hope School for the Deaf to deliver inclusive, barrier-free learning environments. Hands of Hope, founded in 2010 by Sophaphone Heuanglith, provides free education, housing, meals, and medical care to deaf students, empowering them with both academic and vocational skills.

Trading 212 Reports Record Profits in 2024 with Strong User Growth

Trading 212 reports a record £39.7 million profit in 2024, driven by user growth, new products like Cash ISA, and strong trading volumes. Expands into Europe and launches debit card.

Trade Nation Wins "Most Reliable Tech" at the 2025 TradingView Awards

Trade Nation wins "Most Reliable Tech" at the 2025 TradingView Awards, celebrating its cutting-edge technology and commitment to low-cost, fixed spreads for traders.

WikiFX Broker

Latest News

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

Radiant DAO Proposes Compensation Plan for Wallet Losses

BitGo Secures MiCA License, Expands Crypto Services Across the EU

FBI Calls on AML Bitcoin Scam Victims to File Claims by June 5

US Dollar Index Makes a Strong Comeback, Climbs Back to 101.60 Level

Big Changes at Saxo Bank: What Traders and Partners Need to Know

Traders Warned to Stay Alert Amid Growing Exposures for INGOT Brokers

WELTRADE's transformation from Reliable to a Problematic Broker

Deriv Review 2025: A Growing Force in Online Trading

Currency Calculator