简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Something you need to know about ActivTrades

Abstract:WikiFX has given this broker a fairly decent score of 8.27/10. This article is about some details of ActivTrades.

About ActivTrades

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. At ActivTrades, you can trade over 1,000 different CFD instruments across 7 asset classes, including forex, shares, indices, ETFs, commodities, bonds, and spread betting. WikiFX has given this broker a fairly decent score of 8.27/10.

Is ActivTrades Legit?

ActivTrades is a regulated broker. It is regulated by FCA and SCB.

Account Types and Minimum Deposits

ActivTrades offers traders the flexibility to choose between two types of accounts: an Individual Account, which allows trading in small and micro-lots, and a Professional Account, designed for those with a minimum financial portfolio size of $500,000 and comes with a Dedicated Account Manager. Additionally, novice traders can familiarize themselves with the trading interface through a free demo account. For individuals adhering to Sharia law, there are two more account options available, including an Islamic (Swap-Free) Account.

Leverage

ActivTrades complies with EMSA regulations, capping leverage at 1:30. This means that for currency pairs, the maximum leverage is 1:30, for indices and shares it's 1:20, for commodities, it's 1:10, and for cryptocurrencies, it's 1:5. However, Pro account holders have the privilege of accessing the maximum leverage of 1:400.

It's essential to understand that while leverage can amplify profits, it also increases the risk of losing your invested capital. The use of leverage can work both in favor of and against traders.

Spreads and Commissions

ActivTrades offers competitive spreads for currency trading, starting at just 0.5 pips. The same low 0.5 pips spreads apply to indices and financial CFDs, making it an attractive choice for traders.

Furthermore, it's worth noting that adjusting spreads is not an immediate process, as the underlying Futures price already accounts for the change. For trading shares as CFDs, commissions start at €1 per side, while spread betting on shares incurs fees of 0.10% of the transaction value.

Trading Platforms

ActivTrades distinguishes itself with a wide range of trading platforms. In addition to its proprietary platform, ActivTrades offers access to the popular MT4 and MT5 platforms. Moreover, traders can take advantage of a variety of unique Add-Ons, enhancing their trading experience.

Exposures

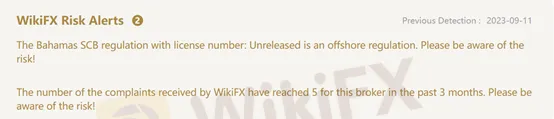

WikiFX has received 27 complaints against ActivTrades within the past three months. While this is not an unusually high number, it does indicate that some traders have had issues with the broker. Potential investors should take these complaints into account when making their decision.

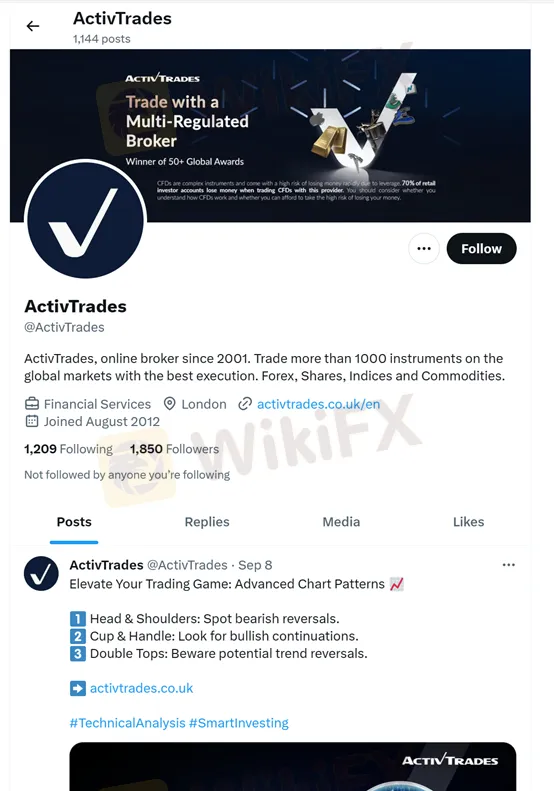

ActivTrades on Social Media

WikiFX Field Investigation

WikiFX conducts field surveys to gather on-the-ground information about brokers. In the case of ActivTrades, WikiFX confirms that the broker does indeed exist, which is a positive sign of legitimacy.

WikiFX Alert

Conclusion

ActivTrades appears to be a reasonably reputable broker with a score of 8.27/10. However, it has received a few complaints within the past three months, indicating that not all traders have had a positive experience.

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction.

Before deciding to invest with ActivTrades or any broker, it's crucial to stay updated with the latest information on WikiFX and conduct your due diligence. Market conditions and broker reputations can change, so make sure to make informed decisions to avoid potential regrets in your trading journey.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

TRADE.com UK sold to NAGA Group for £1.24M after a 65% revenue drop and £346K loss in 2024, marking NAGA's UK return.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

StoneX Subsidiary, Gain Global Markets Bermuda, Penalized for Trading Misconduct

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Currency Calculator