简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

We warn you of a broker called Olymphubs

Abstract: Olymphubs has recently been scrutinized for its questionable practices. A damning 1.29/10 score on WikiFX, a platform dedicated to evaluating forex brokers, sets the stage for an alarming expose of Olymphubs' deceitful tactics.

Olymphubs has recently been scrutinized for its questionable practices. A damning 1.29/10 score on WikiFX, a platform dedicated to evaluating forex brokers, sets the stage for an alarming expose of Olymphubs' deceitful tactics.

About Olymphubs

According to its website, Olymphubs is a solution for creating an investment management platform. It is suited for hedge or mutual fund managers and also Forex, stocks, bonds, and cryptocurrency traders who are looking at running a pool trading system. Online trader simplifies the investment, monitoring, and management process. This firm was registered in the United Kingdom. As far as we know, this broker does not hold a legitimate license. Investing in an unregulated broker is extremely risky as no one can hold them accountable once your money is gone.

Complaints

Recently we received multiple complaints against this broker, which is a red flag.

The Case in Details

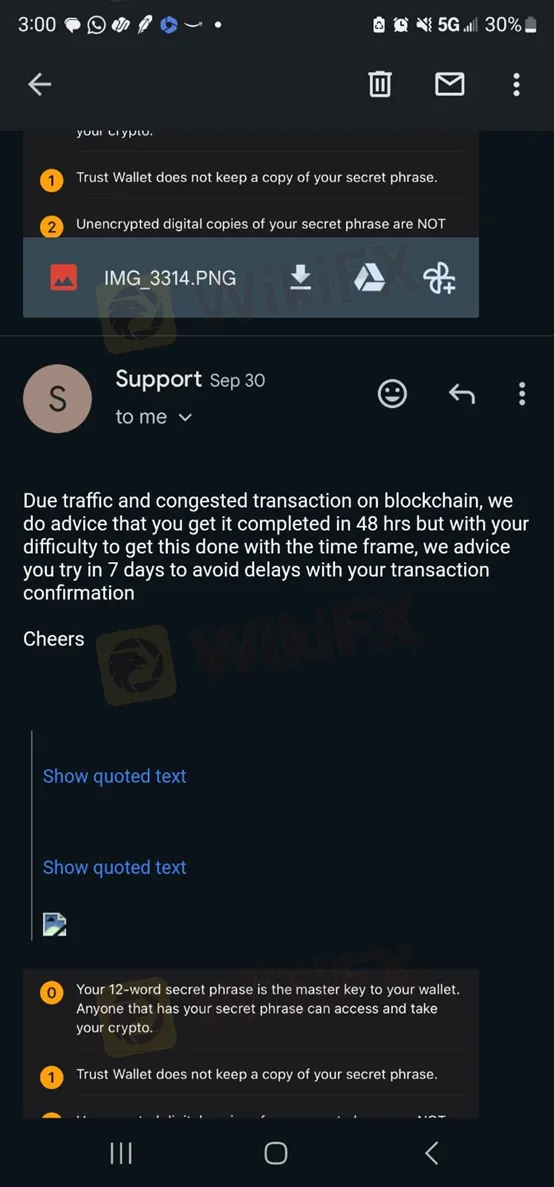

A victim, who fell prey to Olymphubs' dubious schemes, shared a harrowing account of their experience. The victim initially deposited 2 BTC into a gold plan account, expecting to engage in legitimate trading. However, the nightmare began when the victim attempted to make a withdrawal.

First, Olymphubs demanded an additional 10% of the account balance as a processing fee, a tactic not disclosed in their initial agreement. As if that weren't enough, the victim was coerced into paying a $5,000 processing fee due to alleged withdrawal limitations through cash apps and bank transfers.

The victim's resistance to further demands led to a relentless barrage of extortion attempts. Olymphubs insisted on additional fees, including a staggering $10,000 late fee. With each demand met, another emerged, creating a web of financial entanglement.

The victim, facing mounting pressure, deposited an additional $10,000. Despite their compliance, Olymphubs continued to concoct new fees, such as an escrow fee and an activation fee for a trusted wallet. When the victim attempted to withdraw funds, they encountered a series of fabricated issues with the cash app, leading to yet another demand for a reversal fee.

The Breaking Point

The victim reached their breaking point when Olymphubs insisted on processing the withdrawal through a bank transfer. Refusing to succumb to further extortion, the victim stopped depositing funds into their trust wallet. Olymphubs, undeterred, threatened to freeze the victim's account unless they deposited an additional $2,000.

Conclusion

Olymphubs' actions, as described by the victim, paint a grim picture of a forex broker engaging in systematic deception and extortion. Traders should exercise extreme caution when considering Olymphubs as their broker of choice, given the alarming WikiFX score and the distressing account of the victim.

This expose serves as a warning to the trading community, urging individuals to thoroughly research and verify the credibility of forex brokers before entrusting them with their hard-earned funds. Olymphubs, it seems, is not the haven of financial success it claims to be but rather a dangerous trap for unsuspecting traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

IronFX Review 2025: Explore the broker’s AAAA WikiFX rating, global regulations, and $500,000 trading prize. Is it trustworthy or a scam? Dive into our transparent analysis!

TradingPRO: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about TradingPRO and its licenses.

New SEBI Regulations on Intraday Trading

The Securities and Exchange Board of India (SEBI) has implemented revised regulations on Intraday trading, with effect from November 20, 2024. These regulations are meant to lessen risks and prevent speculative trading practices.

WikiFX Broker

Latest News

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Why STARTRADER Is Popular Among Traders?

A Guide to Intraday Forex Trading You Can't Miss Out

CONSOB Blocks Access to 13 Unauthorized Investment Websites

TradingPRO: A Closer Look at Its Licences

The world could be facing another ‘China shock,’ but it comes with a silver-lining

New SEBI Regulations on Intraday Trading

Everything You need to know about Barath Trade

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

Currency Calculator