简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Only Checklist You Need for FX Broker Selection!

Abstract:"Finding the best forex broker isn't easy. It's about considering important things, not just one 'best' choice. Let's explore the key factors that make a broker good."

In the ever-evolving landscape of forex trading, the search for the ultimate broker remains a quest marked by nuanced considerations. The notion of a solitary “best forex broker” dissolves under the scrutiny of specific, pivotal criteria that each brokerage must weather.

1. Spread/Commissions – The Cost of Transactions

Within the realms of forex trading, the price of transactions, quantified as spreads and commissions, exerts a direct influence on gains. While seemingly inconsequential for novices engaged in limited trade volumes, these expenses burgeon in significance as trade volumes surge.

2. Leverage – A Changing Landscape

Leverage and margins have undergone substantial reductions under prevailing regulations. Despite this, unregulated brokers may still entice traders with the allure of high leverage.

3. Regulation – Ensuring Trade Integrity

The cornerstone of reliability in forex trading lies within regulatory compliance. Regulatory oversight nurtures trade transparency and fortifies trader security, rendering regulated brokers more trustworthy. However, divergent regulations can inadvertently shackle trade possibilities.

4. Safety of Funds – The Brokers Responsibility

Fund and data safety epitomize a broker's integrity. The segregation of client funds from the company's finances reigns supreme, ensuring a safety net in dire circumstances like bankruptcy.

5. Broker Type – Direct vs. Indirect Access

Brokerages unveil either direct or indirect pathways to the forex market. Indirect brokers maneuver through the interbank market, vending positions to traders with modest initial balances and fixed spreads. On the contrary, direct brokers mandate higher capital but offer variable spreads.

6. Trading Resources – The Power of Information

Vital to traders are the resources proffered by brokers: market insights, analysis, historical data, and a plethora of currency pairs. Striking a balance in the volume of data is imperative; an overflow may prove distracting.

7. Customer Support – A Pivotal Pillar

Irrespective of a trader's prowess, robust support channels and empathetic assistance from brokers stand as cornerstones in this domain.

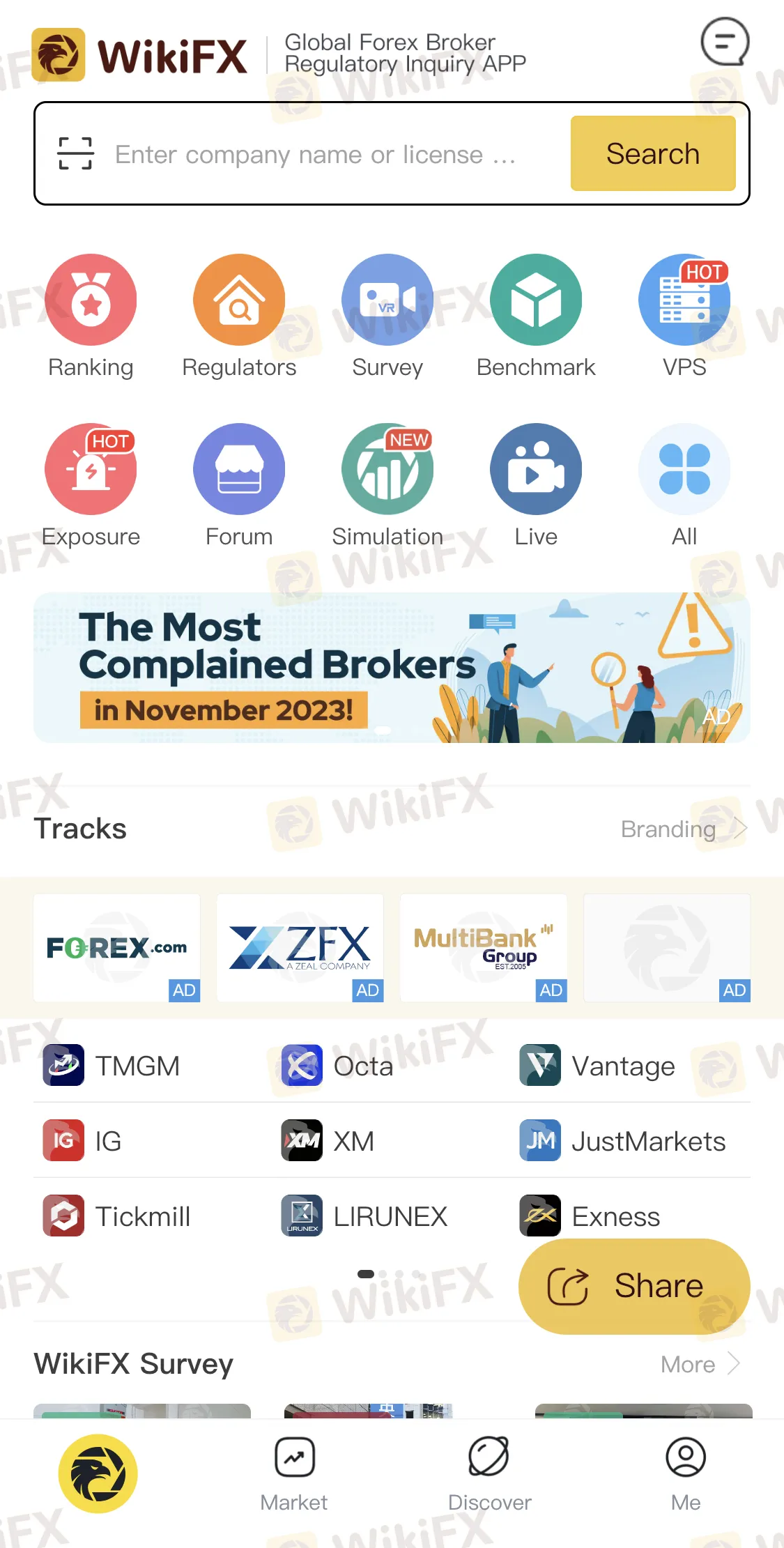

WikiFX, the premier global forex broker regulatory query platform, stands as an indispensable tool for traders seeking safe and reliable brokerages. With an extensive database and user-friendly interface, WikiFX provides an in-depth analysis of brokerages' regulatory compliance, user reviews, and transparency levels. The platform's unique features include comprehensive reports on broker legitimacy, ensuring traders make informed decisions. Whether it's verifying a broker's regulatory status, accessing authentic user reviews, or staying updated on crucial industry news, WikiFX's free mobile application, available on Google Play and the App Store, offers unparalleled convenience. Empowering users with detailed insights and real-time information, WikiFX remains committed to ensuring traders have the resources needed to navigate the complex world of forex trading confidently.

Download yours now for free, or visit www.wikifx.com without further ado.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

Errante Broker Review

Established in 2020, Errante has rapidly gained recognition in the forex and CFD trading industry. With a commitment to transparency, client protection, and a diverse range of trading services, Errante caters to both novice and experienced traders. This review provides an in-depth look at Errante's offerings, regulatory standing, trading conditions, and more.

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

IronFX Review 2025: Explore the broker’s AAAA WikiFX rating, global regulations, and $500,000 trading prize. Is it trustworthy or a scam? Dive into our transparent analysis!

Why Your Worst Enemy in Trading Might Be You

Be Honest With Yourself: Are You Slowly Destroying Your Trading Account?

WikiFX Broker

Latest News

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Everything you need to know about ADSS

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

Interactive Brokers: Global Office Visits and Licensing Details

U.S. Jobs Data Released: A Potential Boost for Gold Prices

Currency Calculator