简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Swissquote Bank Europe Appoints Jack Ehlers as New Chief Operating Officer

Abstract:Meet Jack Ehlers, Swissquote Bank Europe's new COO, driving excellence in digital investing. Learn about the bank's growth and regulatory status.

Swissquote Bank Europe, a leader in online financial and trading services, is proud to announce the appointment of Jack Ehlers as its new Chief Operating Officer (COO), effective from 1 January 2024. This strategic appointment is a testament to the bank's commitment to expanding its operational capabilities and reinforcing its position in the digital investing sphere.

What Does the Appointment of Jack Ehlers Mean for Swissquote Bank Europe?

Jack Ehlers brings with him a wealth of experience in the financial services sector, having worked with notable companies across Europe, Asia, and the United States, including Paypal, Alipay, and Bitstamp. His expertise in scaling fast-growing businesses, creating innovative products, and establishing robust operational frameworks will be invaluable to Swissquote Bank Europe as it looks to enhance its services and reach.

“I am very excited to join Swissquotes Luxembourg-based team and contribute to its growth,” said Jack Ehlers. “My goal is to enable the bank to develop further and ensure the highest level of operational and technology excellence.”

How Will Jack Ehlers' Role Impact Swissquote Bank Europes Future?

As COO, Ehlers will play a crucial role in shaping the future trajectory of Swissquote Bank Europe. His leadership is expected to drive the development of new products and market expansions, further cementing the bank's reputation for operational excellence and innovation.

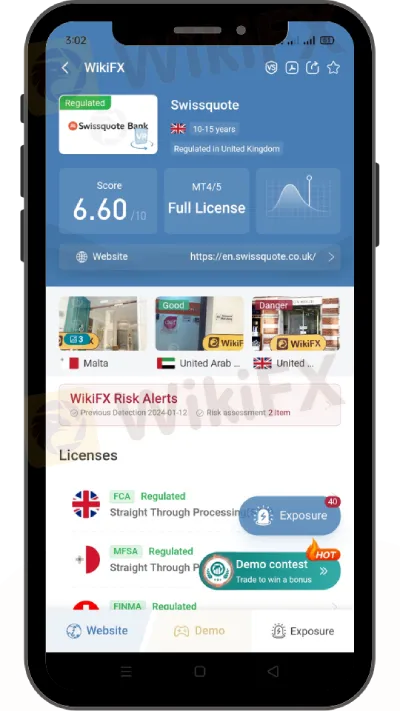

Swissquote Bank and Its Regulatory Status

Swissquote Bank Europe, formerly known as Internaxx Bank, is a fully regulated entity. In 2023, it was approved by Luxembourgs financial regulator to act as a depositary bank for Luxembourg-domiciled funds. This regulatory milestone underscores the bank's compliance with the highest standards of financial governance and its commitment to providing secure and reliable services to its clients.

Bottom Line

The appointment of Jack Ehlers as COO is a significant move for Swissquote Bank Europe. It aligns with the bank's strategy of continuous growth and innovation in the digital financial services space. With its strong regulatory status and expansion plans, Swissquote Bank Europe is well-positioned to maintain its leading role in the industry and deliver exceptional value to its clients.

About Swissquote Bank Europe

Swissquote Bank Europe, part of the Swissquote group, is a pioneering force in online financial and trading services. The group employs over 1,000 professionals worldwide and is known for its innovative approach to digital investing. Swissquote Bank Europe continues to build on its legacy of excellence, driven by a commitment to operational and technological advancements in the financial sector.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

U.S. nonfarm payrolls for May slightly exceeded expectations, stabilizing investor sentiment and easing fears of a hard landing. This upbeat data sent U.S. equities broadly higher, led by tech stocks, with the Dow and S&P 500 posting significant gains. However, behind the optimism lies a fresh round of market debate over the Federal Reserve’s rate path, with uncertainty around inflation and interest rates remaining a key risk ahead.

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

Errante Broker Review

Established in 2020, Errante has rapidly gained recognition in the forex and CFD trading industry. With a commitment to transparency, client protection, and a diverse range of trading services, Errante caters to both novice and experienced traders. This review provides an in-depth look at Errante's offerings, regulatory standing, trading conditions, and more.

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

IronFX Review 2025: Explore the broker’s AAAA WikiFX rating, global regulations, and $500,000 trading prize. Is it trustworthy or a scam? Dive into our transparent analysis!

WikiFX Broker

Latest News

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Why STARTRADER Is Popular Among Traders?

A Guide to Intraday Forex Trading You Can't Miss Out

CONSOB Blocks Access to 13 Unauthorized Investment Websites

TradingPRO: A Closer Look at Its Licences

The world could be facing another ‘China shock,’ but it comes with a silver-lining

New SEBI Regulations on Intraday Trading

Everything You need to know about Barath Trade

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

Currency Calculator