简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

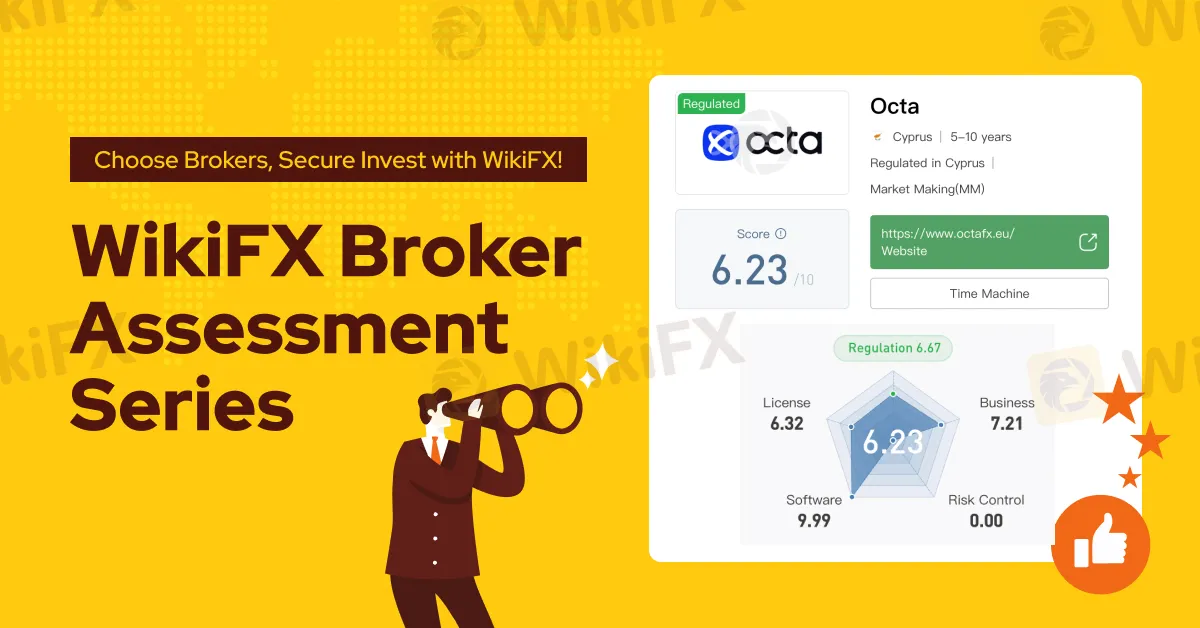

The Most Comprehensive Review of Octa in 2025

Abstract:This article reviews the broker from multiple dimensions, including basic introduction, Features, fees, security, account opening, and trading platforms.

Basic Introduction

Founded in 2011, OCTA is a global multi-asset CFD broker. According to its website, OCTA has opened over 21 million trading accounts for users in 180 countries and regions.

OCTA offers CFDs on 250 major asset classes, including MetaTrader 4, MetaTrader 5, and its proprietary OctaTrader platform. With competitive spreads, abundant research and educational materials, and diverse payment options, OCTA showcases its innovative business model and dedication to meeting customer needs.

Features

OCTA offers tight forex spreads, effectively reducing trading costs. The platform also provides extensive research materials to help traders better analyze market trends. Its customer support team is available 24/7, ensuring traders can get assistance at any time. OCTA charges no inactivity or swap fees, and deposits and withdrawals are free, offering traders greater flexibility and cost-effectiveness.

Fees

OCTA excels in fees, with tight spreads on forex and stock CFDs. It also breaks industry norms by not charging swap fees or inactivity fees. For both trading accounts (OctaFX MT4 and OctaFX MT5), all fees are included in the spreads, with no additional commissions.

OCTA does not charge inactivity or account maintenance fees.

Trading Platforms

OCTA offers popular trading platforms available on desktop, web, and mobile devices, including MetaTrader 4 and MetaTrader 5. These platforms feature powerful charting tools and a variety of order types, supporting automated trading. For beginner users, OCTA also offers the web-based OctaTrader platform, which is simple and easy to use, making it suitable for newcomers.

Product Offerings

OCTA provides a variety of trading tools, including CFDs on all major asset classes: forex, commodities, indices, stocks, and cryptocurrencies. OCTA has a wide range of cryptocurrency CFDs available, totaling 30 options. The range of index CFDs is also above average.

OCTA offers multiple trading products such as forex, commodities, indices, and stocks, with its index CFDs selection also exceeding the industry average.

For most individual investors, these products are sufficient to cover major investment needs.

If you'd like to learn more about a specific brokers reliability, you can visit our website (https://www.WikiFX.com/en). Or you can download the WikiFX App to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Urges Financial Licensees to Fix Register Errors Before 2026 Deadline

eToro Review 2025: Top Trading Opportunities or Hidden Risks?

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

Interactive Brokers: Global Office Visits and Licensing Details

U.S. Jobs Data Released: A Potential Boost for Gold Prices

Everything you need to know about ADSS

Currency Calculator