简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

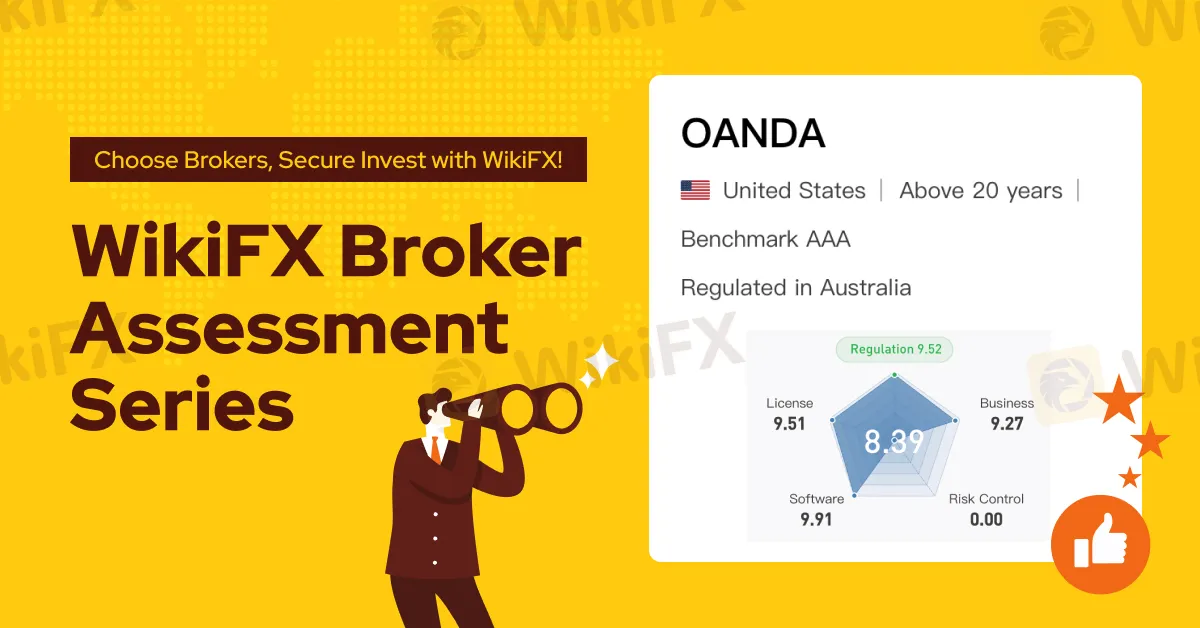

OANDA 2025 Most Comprehensive Review

Abstract:This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

OANDA is a well-known brokerage established in the United States, primarily offering forex trading services. It also allows EU clients to trade U.S. stocks, expanding its global reach. OANDA is renowned for its user-friendly trading platforms and powerful research tools, making it particularly suitable for beginner investors. The account opening process is straightforward and fast, making it an ideal choice for those entering the market.

OANDA's trading platforms perform excellently, offering useful features like chart customization and price alerts. Both the mobile and web platforms share the same functionalities, providing a highly user-friendly experience. The desktop platform excels in customizability, order types, and portfolio reporting.

OANDA also offers an extensive range of research tools, including various technical indicators and a robust API, to help investors conduct in-depth market analysis.

Fee Structure

OANDA sets a low-cost fee structure with competitive spreads for forex and CFD trading. The minimum deposit is $0, and withdrawal fees are also $0. Additionally, the first card withdrawal each month is free, providing convenience for users in managing their funds. All trading fees are included in the spread, so no separate commissions are charged. For example, the spread for EUR/USD is 1.0.

Product Range

OANDA offers a wide range of products, including forex, CFDs, and cryptocurrencies. These products meet the needs of various investors, from beginners to experienced traders, with tools suitable for all types of market participants. Its diverse product offerings make it a preferred platform for global investors.

Overall, OANDA is a reliable brokerage with its low trading costs, user-friendly platforms, rich research tools, and diversified product offerings. For investors seeking a trustworthy trading platform, OANDA is undoubtedly a solid choice.

To learn more about the reliability of specific brokers, feel free to visit our website (https://www.WikiFX.com/en) or download the WikiFX App, helping you find the most trusted brokers to ensure your trading is safer and more reliable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What WikiFX Found When It Looked Into Exclusive Markets

In the fast-growing world of online trading, security and regulation are essential. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

Warnings Emerge Over ACY Securities: Profits Denied, Accounts Frozen

A growing number of traders are reporting withheld profits, arbitrary accusations, and withdrawal restrictions at ACY Securities, raising serious concerns about the broker’s transparency and reliability.

ActivTrades: A Closer Look at Its Licences

In an industry where safety and transparency are paramount, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Vantage Markets, a well-known name in the online trading space, has recently come under review. Keep reading to learn more about ActivTrades and its licenses.

eToro Review 2025: Top Trading Opportunities or Hidden Risks?

Is eToro a trustworthy broker or a scam in 2025? Explore its regulations, user reviews, and reputation to decide if it’s safe for trading forex, stocks, and crypto. Read now!

WikiFX Broker

Latest News

Crypto News: $1 Trillion Managed Funds Fail Key Compliance Tests

No worries — You can invest with these offshore regulated brokers

BaFin Issues Multiple Warnings Against Unlicensed Financial Services and Identity Fraud

He Thought It Was an Investment, Now RM900,000 Is Gone

ASIC Urges Financial Licensees to Fix Register Errors Before 2026 Deadline

HYCM Reshapes Its Business After £1.4 Million Management Takeover

Phyntex Markets Broker Review

eToro Renews AZ Alkmaar Sponsorship as Football Faces Big Changes

MH Markets Introducing Broker (IB) Program

Spreadex’s New Client Offer: 6 Months of the Financial Times

Currency Calculator