简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

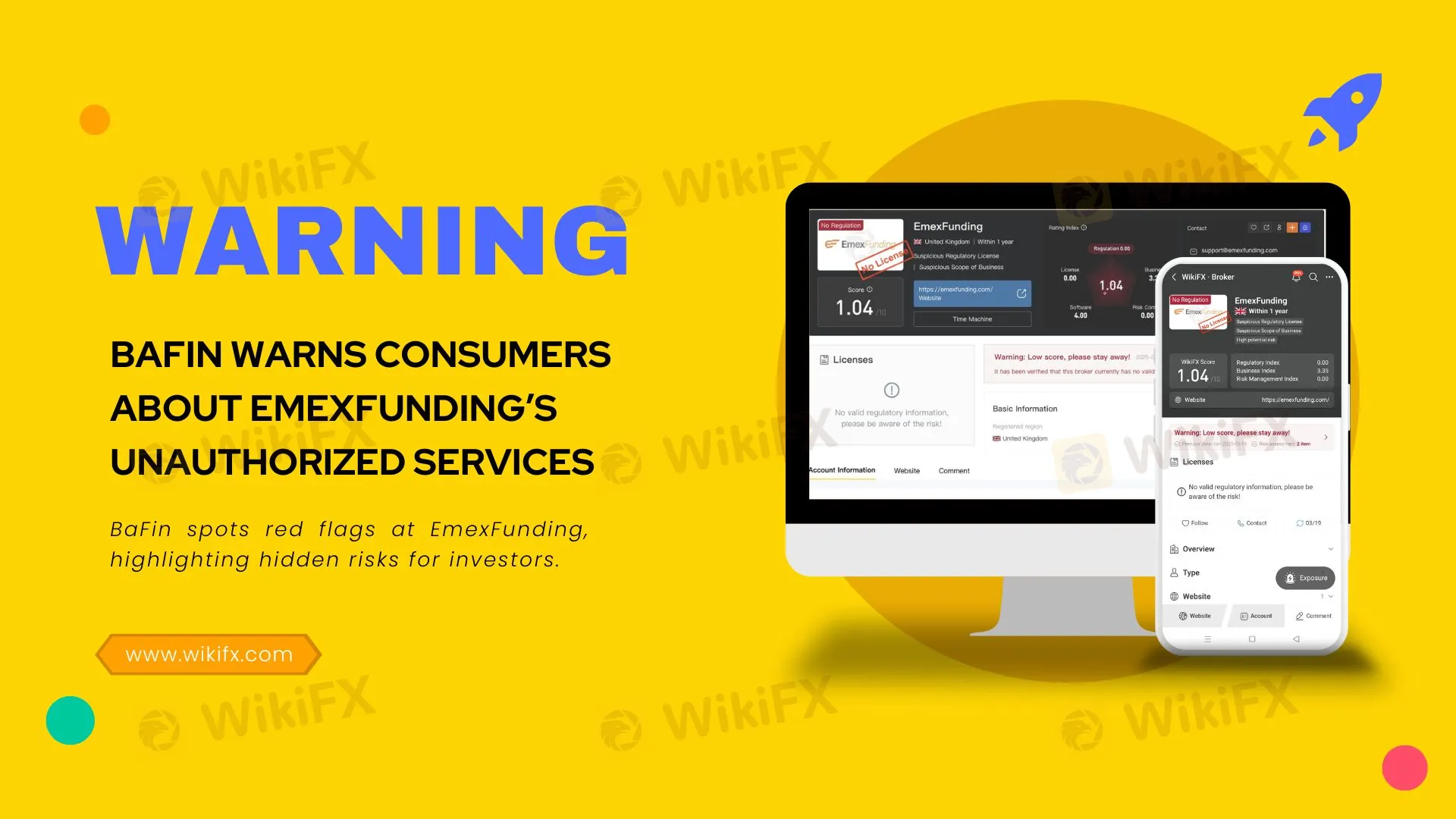

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Abstract:BaFin spots red flags at EmexFunding, highlighting hidden risks for investors.

The German Federal Financial Supervisory Authority (BaFin) has issued a critical consumer alert about the activities of EmexFunding, an unauthorized financial services provider operating through the website emexfunding.com.

BaFin's investigation revealed that EmexFunding, whose operators remain unidentified, is offering financial, investment, and cryptocurrency services without the necessary regulatory permissions. The company falsely operates under the business name “EmexFunding GmbH,” claiming its registered office is in Corby, United Kingdom. However, official records verify that such a company does not exist, indicating a clear attempt to mislead potential customers.

A significant concern raised by BaFin involves EmexFunding's promotion of a so-called “Handelskreditvertrag” (trading credit agreement). Through this misleading document, the firm encourages consumers to secure loans specifically for trading financial products and cryptoassets on its platform. Such tactics pose considerable risks, potentially leading consumers into substantial financial losses and debt.

Under German legislation—including the German Banking Act (Kreditwesengesetz - KWG) and the German Cryptomarkets Supervision Act (Kryptomärkteaufsichtsgesetz)—entities must obtain explicit authorization from BaFin to offer financial or investment-related services. EmexFunding lacks such authorization, rendering its operations unlawful and exposing investors to significant risks.

Additionally, a search conducted through the regulatory verification platform WikiFX corroborates BaFin's concerns. WikiFX reports EmexFunding as having no valid regulatory licenses and assigns it a notably low reliability rating, further emphasizing the dangers of engaging with this unauthorized provider.

BaFin strongly advises investors to perform thorough due diligence by consulting official regulatory databases and trusted platforms such as WikiFX before committing funds to any financial service providers. Engaging with unauthorized companies such as EmexFunding can result in limited legal protections and the inability to recover invested funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exnova Forex Broker Scam: Blocked Accounts, Lost Funds

Exnova forex broker slammed for scam tactics, blocking withdrawals, and dodging regulation. Victims warn of fraud risks—steer clear!

TriumphFX Faces 29 Exposure Reviews on WikiFX

TriumphFX faces scrutiny with 29 exposure reviews on WikiFX, revealing regulatory warnings from ID BAPPEBTI, VU VFSC, SG MAS, and MY SCM, plus user complaints about withdrawal issues and fraud concerns.

What WikiFX Found When It Looked Into Exclusive Markets

In the fast-growing world of online trading, security and regulation are essential. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

TriumphFX Review 2025: A Safe Bet or a Risky Trap?

Is TriumphFX a trustworthy broker or a scam in 2025? This review explores its regulation, withdrawal issues, and more to help you decide if it's a safe bet or a risky trap.

WikiFX Broker

Latest News

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

OctaFX Flagged by Malaysian Authorities

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

Interactive Brokers Enhances PortfolioAnalyst with New Features

Why Your Worst Enemy in Trading Might Be You

Errante Broker Review

SFC Issues Restriction Notice to GA (Int’l) Capital Management Limited Over Regulatory Concerns

Exnova Forex Broker Scam: Blocked Accounts, Lost Funds

Currency Calculator