简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RM93,800 Vanished After Joining ‘AW-A11 William Contest Community’

Abstract:A 37-year-old man lost a total of RM93,800 after falling victim to a fraudulent online investment scam that began with a Facebook advertisement that led him to a WhatsApp group called “AW-A11 William Contest Community.”

A 37-year-old man lost a total of RM93,800 after falling victim to a fraudulent online investment scam that began with a Facebook advertisement.

According to the police report, the victim came across the investment ad while browsing Facebook in March. Upon clicking the link, he was added to a WhatsApp group called “AW-A11 William Contest Community.”

Within the group, purported members frequently shared “success stories” and screenshots showing lucrative returns from their investments. These constant displays of apparent profitability convinced the victim that the scam was both safe and highly rewarding.

Between May 23 and June 17, the victim transferred a total of RM93,800 to a company bank account provided by the scammers.

However, on July 21, the perpetrators contacted him again, urging him to invest an additional RM60,000, claiming it would yield even greater returns. When the victim explained he could not afford to invest more, the scammers became increasingly aggressive and used coercive language to pressure him into complying.

Despite repeated requests for further funds, the victim never received any returns on his investment. Realizing he had been scammed, he filed a police report.

Police have confirmed they are investigating the case under Section 420 of the Penal Code for cheating.

Authorities are once again urging the public to exercise extreme caution with any online investment involving financial transactions. Members of the public are advised not to be lured by promises of high returns, especially from schemes promoted via social media or private chat groups.

Anyone who encounters suspicious investment offers is encouraged to contact the National Scam Response Centre hotline or verify the legitimacy of the company through Bank Negara Malaysia's official website.

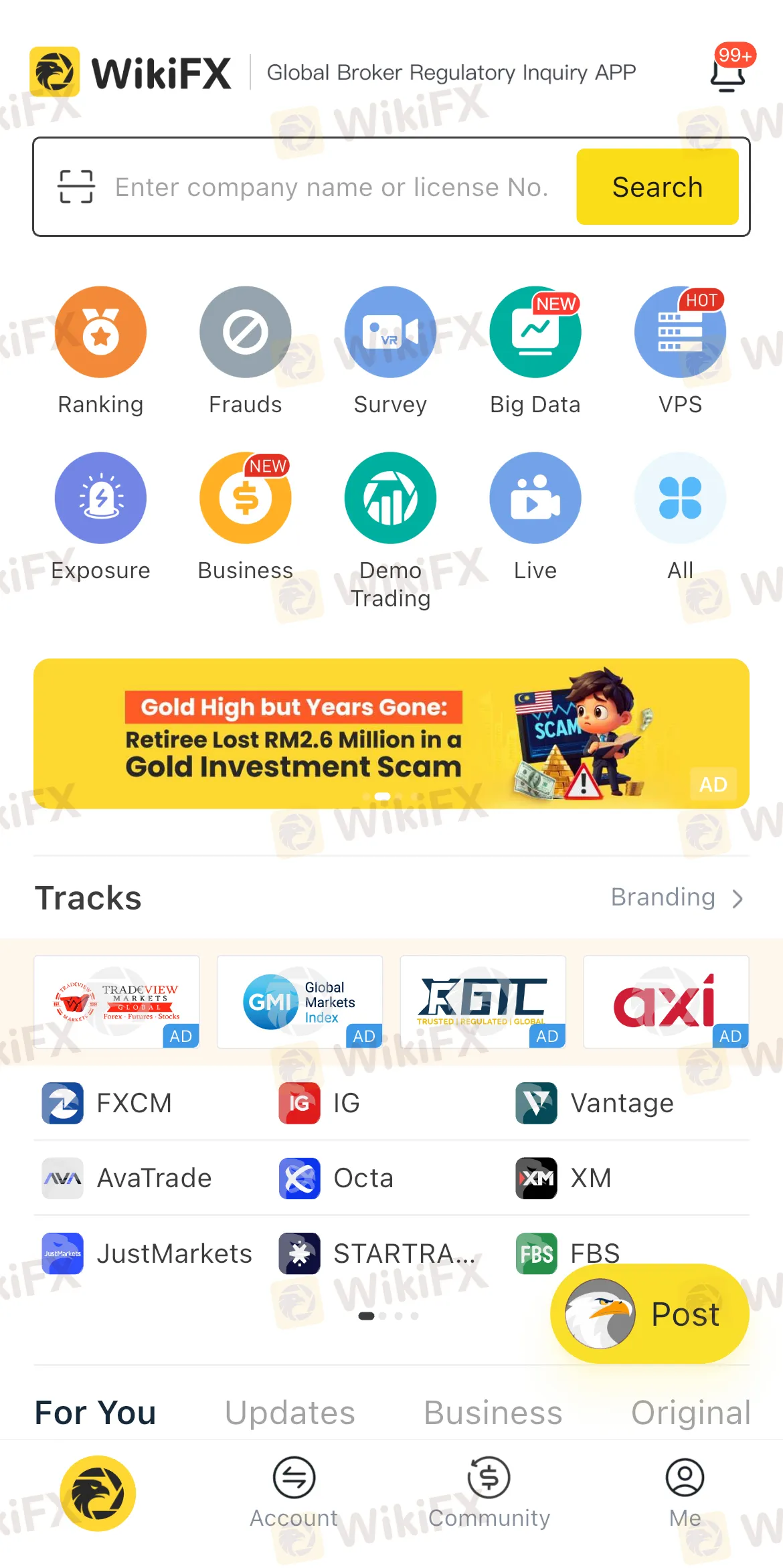

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

WikiFX Broker

Latest News

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

How to Use Retracement in Trading

CySEC warns the public against 17 investment websites

Robinhood Moves Toward MENA Expansion with Dubai DFSA License Application

FBI Issues Urgent Warning on Crypto Recovery Scams

Germany's Industrial Core Is Collapsing Under The US Trade Deal And The Green Agenda

Understanding Forex Spread Cost and How to Minimize It

Juno Markets: A Closer Look at Its Licenses

Complaints Against Weltrade | Traders Can’t Get Their Money Back

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

Currency Calculator