简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MarketsVox Exposed: The Tactics Draining Traders’ Hard-Earned Capital

Abstract:Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. This made us introspect on the forex broker, and we found out some stunning complaints against it. Read on to know the complaints.

Stunning Complaints Against MarketsVox You Must Read

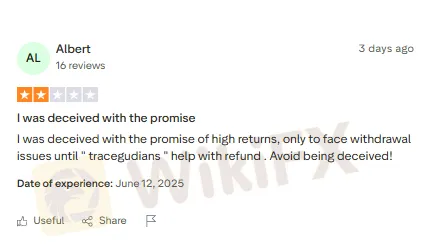

MarketsVox Fails to Deliver on High-return Promises

MarketsVox keeps acquiring customers by emphasizing high-return claims. Forex investments do yield substantial returns for investors. However, the yield comes when invested and not when used for other means. Here is one trader who made this specific complaint against MarketsVox.

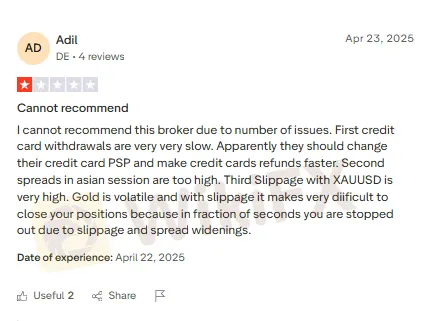

Slow Credit Card Withdrawals and High Slippage and Spreads Annoy Traders

Traders are annoyed with MarketsVox over multiple trading issues. These include slow-paced withdrawals via credit cards, high slippage with XAU USD, and excessive spreads in Asian trades. Due to high slippage and spreads, traders cannot close their positions with ease. One such trader has expressed annoyance through this comment.

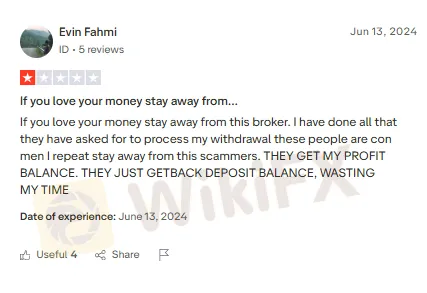

You May Access Your Deposit, But Not Profit

While withdrawal has always been an issue for traders at MarketsVox, in certain cases, it may allow you to access the deposits you make. As returns compound on your investments, you would like to withdraw them too. But unfortunately, you may not be able to do so. Such has been the case with this trader, who cautions others from trading with this forex broker.

WikiFX Opines on MarketsVox

Nothing much to talk about. MarketsVox, which despite being regulated in Seychelles, has been defrauding investors with a wide range of trade manipulations and tricks. Given the massive trader complaints, WikiFX, a leading forex broker regulation inquiry app, gives it a score of just 1.97 out of 10.

Here is an important update for you!

WikiFX Masterminds is launched, where you can discuss forex 24/7.

Here is how you can join it to discuss.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Thats it, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

WikiFX Broker

Latest News

Scam Alert: Know the Risky Side of InstaForex in India

Going to Invest in FXCL? Move Back to Avoid Scams & Losses

What Is Forex Trading Fee? A Beginner’s Guide

Understanding UAE’s Financial Market Regulation: SCA and DFSA

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

FBI Issues Urgent Warning on Crypto Recovery Scams

Robinhood Moves Toward MENA Expansion with Dubai DFSA License Application

How to Use Retracement in Trading

CySEC warns the public against 17 investment websites

IBKR Lite Singapore Debuts with Zero-Commission US Stock Trading

Currency Calculator