简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into TradeFW

Abstract:In today’s fast-moving online trading world, regulation and safety are more important than ever. TradeFW claims to be a regulated broker, but a closer look at its licence and operations reveals a more complex picture.

In todays fast-moving online trading world, regulation and safety are more important than ever. TradeFW claims to be a regulated broker, but a closer look at its licence and operations reveals a more complex picture.

In online trading, choosing the right broker can make the difference between protecting your money and losing it. TradeFW presents itself as a regulated company, but a deeper review raises serious questions about its credibility.

The broker is licensed by the Cyprus Securities and Exchange Commission (CySEC) under licence number 298/16, operating with a Straight Through Processing (STP) model. While CySEC is a recognised regulator within the EU, its rules and investor protections are not as strict as those enforced by top-tier regulators such as the UK‘s Financial Conduct Authority (FCA) or Australia’s Securities and Investments Commission (ASIC).

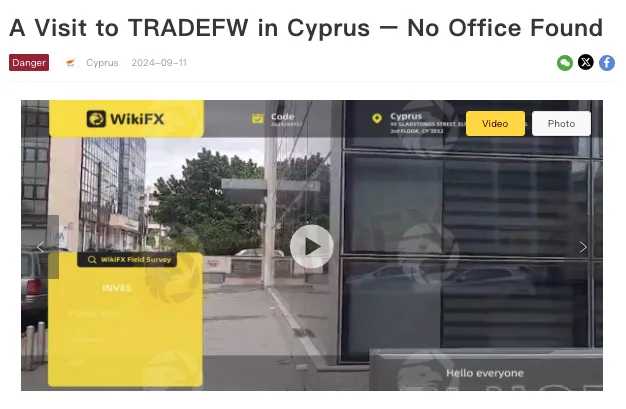

Concerns about TradeFW grew after WikiFX, an independent broker review platform, carried out an on-site check at the companys official address in Cyprus. WikiFX, which tracks licences from over 40 global regulators and collects user complaints, reported that its team could not find the company at the address it had registered. This raises serious doubts about whether TradeFW has a real office there. (Full report: https://www.wikifx.com/en/survey/821406e8f5.html)

The absence of a verifiable office presence undermines both transparency and accountability. If a broker cannot be physically located at its registered address, it becomes significantly harder for regulators or affected investors to resolve disputes or take enforcement action in the event of misconduct.

WikiFX assigns trust scores to brokers based on a combination of factors, including regulatory standing, operational transparency, and user feedback. While TradeFW is technically regulated by CySEC, the combination of concerns about its physical presence and the limitations of CySEC‘s supervisory framework has raised doubts among many market watchers about the broker’s overall reliability. Investors are strongly advised to exercise caution and carry out comprehensive due diligence before engaging with any broker, particularly those operating under regulatory authorities perceived to have lighter oversight. Assessing a brokers full regulatory profile, operational transparency, and verifiable presence can help mitigate risks in an industry where unregulated or loosely regulated entities have caused significant financial harm.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 5 Warning Signs- Why You Should Avoid MTrading Broker?

Before choosing a forex broker, it's crucial to spot red flags that could cost you. MTrading has raised concerns among traders, including delayed withdrawals, poor customer support, and questionable transparency. Users also report issues like slippage and platform glitches, which can harm your trading performance. In this article, we highlight the top 5 warning signs that explain why you should avoid MTrading broker and choose a more reliable alternative.

MarketsVox Exposed: The Tactics Draining Traders’ Hard-Earned Capital

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Top Forex Demo Accounts for Beginners

In this guide, we will explore the top forex demo accounts for beginners. We aim to help you find the best platform for your trading practice. Let's dive into the world of forex demo accounts and discover the best options available.

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

Planning to invest in OnFin, the forex broker, which has been a nightmare for many forex traders? While withdrawal denials have remained perennial for them, trading manipulations, including the illegitimate disappearance of deposits, have put OnFin under the scanner. Traders have been vehemently expressing their frustration about the forex broker on various broker review platforms. In this article, we will share some complaints that made us expose this broker here.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

Quotex Broker Review 2025: Is It a High-Risk Broker?

Is CBCX a Safe and Trustworthy Broker for Traders?

TopFX Launches Synthetic Indices Trading on cTrader Platform

Is TradeEU Reliable in 2025?

How Commodity Prices Affect Forex Correlation Charts

What WikiFX Found When It Looked Into XS

The Global Inflation Outlook

Currency Calculator