简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Charles Schwab Forex Review 2025: What Traders Should Know

Abstract:An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Profile Overview

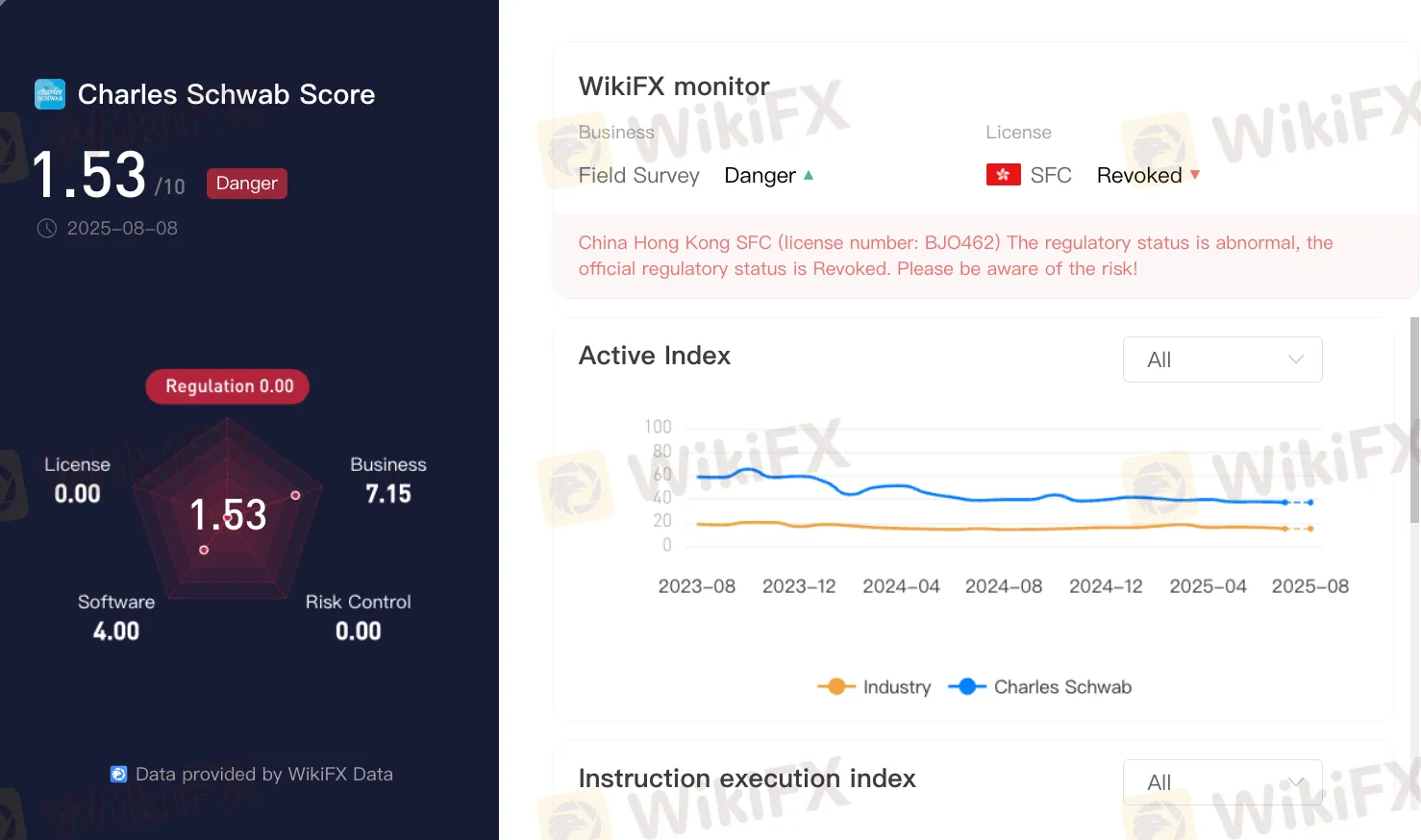

Charles Schwab is widely known as a major U.S. brokerage brand, but its presence in the forex market is limited. According to its broker profile, the company holds a rating of 1.53/10 with clear risk alerts and no active forex regulation displayed. Historical records also show a revoked Hong Kong futures licence connected to a previously affiliated entity.

Regulation and Historical Licensing

The profile data shows no current forex-specific regulatory licence. The revoked licence on record pertains to a Hong Kong futures authorisation, which is no longer active. While Charles Schwab operates in highly regulated U.S. securities and futures markets, these frameworks do not substitute for dedicated retail forex oversight in jurisdictions where such licensing is required.

Trading Services and Platform Offering

Schwab offers foreign exchange access primarily through Charles Schwab Futures and Forex LLC, focusing on select clients who meet eligibility requirements. This service is integrated within the companys proprietary trading systems rather than popular retail platforms like MT4 or MT5. For traders accustomed to retail-oriented FX environments with flexible account options and high-frequency execution, the structure may feel restrictive.

Geographic and Client Limitations

The forex service is not universally available. Access depends on client residency, account type, and meeting specific eligibility criteria. In some regions, Schwab does not provide retail forex trading at all, aligning more with its institutional and professional focus.

Assessment for Retail Traders

From a forex-only perspective, the combination of a low profile rating, absence of active FX regulation on record, and limited retail access makes Charles Schwab an unsuitable choice for traders seeking a dedicated, retail-focused forex broker. While the brand remains reputable in equities, ETFs, and wealth management, its role in the forex market is specialised and not designed for broad retail participation.

Conclusion

Charles Schwabs strength lies in its traditional brokerage and investment services, not in providing a wide-access retail forex platform. For traders whose primary interest is forex, especially on MT4/MT5 with competitive retail terms, alternative brokers with active forex regulation and higher FX-focused ratings should be considered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 5 Warning Signs- Why You Should Avoid MTrading Broker?

Before choosing a forex broker, it's crucial to spot red flags that could cost you. MTrading has raised concerns among traders, including delayed withdrawals, poor customer support, and questionable transparency. Users also report issues like slippage and platform glitches, which can harm your trading performance. In this article, we highlight the top 5 warning signs that explain why you should avoid MTrading broker and choose a more reliable alternative.

MarketsVox Exposed: The Tactics Draining Traders’ Hard-Earned Capital

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

Planning to invest in OnFin, the forex broker, which has been a nightmare for many forex traders? While withdrawal denials have remained perennial for them, trading manipulations, including the illegitimate disappearance of deposits, have put OnFin under the scanner. Traders have been vehemently expressing their frustration about the forex broker on various broker review platforms. In this article, we will share some complaints that made us expose this broker here.

MyFundedFX Review 2025

MyFundedFX Review 2025 — unregulated prop-style broker with simulated trading, mixed trust signals, rule changes, and payout claims. Is it high risk?

WikiFX Broker

Latest News

Datuk Seri Linked to RM8.4 Million Gold Investment Scam Under Police Probe

The Psychology Behind the Ascending Triangle Pattern in Forex

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

What WikiFX Found When It Looked Into XS

ASIC Regulated Forex Brokers: A Comprehensive 2025 Guide

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

Is TradeEU Reliable in 2025?

Professional Forex Trading: Skills, Tools, & Strategies for Success

Currency Calculator