Key Events This Very Busy Week: CPI, PPI, Retail Sales, Tons Of Fed Speakers And Earnings Season Begins

Özet:As trade letters from the US continue to get mailed out, DB's Jim Reid writes that April 2nd has bec

As trade letters from the US continue to get mailed out, DB's Jim Reid writes that April 2nd has become July 9th which has become August 1st for an ever increasing list of countries. In the early hours of Saturday, Trump‘s stationary cupboard was opened again and a letter was sent to the EU and Mexico informing them that they would face 30% tariffs on August 1st. To be fair, a month ago Trump threaten the EU with a 50% tariff so you might argue this is an improvement! The market will generally think this is mostly a negotiating tactic and that we’re unlikely to see such rates. The EU have been measured in their response so far and have extended the suspension of trade countermeasures that were supposed to kick-in tomorrow night. This will now be aligned to the August 1st deadline. So the EU and the market are hoping and expecting diplomacy to win out.

However at some stage, the DB strategist warns that someones bluff could be called. Trump is under less pressure to back down with US risk markets around their highs and bond markets relatively stable at the moment. If huge tariffs do get imposed on August 1st, in thin holiday markets, we could get a sizeable market reaction. So the next three weeks of negotiating will be key to restful holidays everywhere.

One thing is certain: much will still depend on the inflation trajectory. If all is calm on this front then we could move on but if we start to see slippage here, then a removal of a Fed Chair could be a big problem, at least initially, for a country with huge twin deficits.

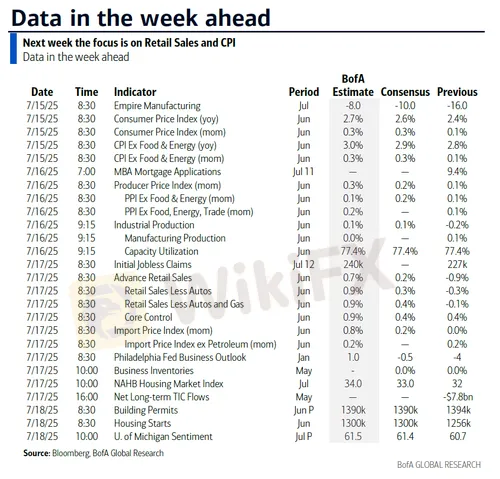

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists‘ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Feds preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of “Crypto Week” where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Monday July 14

- Central banks: ECB's Vujcic and Cipollone speak

Tuesday July 15

- Central banks: Fed's Bowman, Barr, Collins and Barkin speak, BoE's Bailey speaks

- Earnings: JPMorgan Chase, Wells Fargo, Blackrock, Citigroup, Bank of New York Mellon

Wednesday July 16

- Data: US June PPI, industrial production, capacity utilisation, July New York Fed services business activity, UK June CPI, RPI, May house price index, Italy May trade balance, Eurozone May trade balance, Canada June housing starts

- Central banks: Fed's Beige Book, Fed's Logan, Hammack, Barr, Williams and Barkin speak

- Earnings: Johnson & Johnson, Bank of America, ASML, Morgan Stanley, Goldman Sachs, Kinder Morgan, Sandvik, United Airlines, Alcoa

Thursday July 17

- Data: US June retail sales, import price index, export price index, July Philadelphia Fed business outlook, NAHB housing market index, May business inventories, total net TIC flows, initial jobless claims, UK May average weekly earnings, unemployment rate, June jobless claims change, Japan June trade balance, Canada May international securities transactions, Australia June labour force survey

- Central banks: Fed's Kugler, Daly, Cook and Waller speak

- Earnings: TSMC, Netflix, General Electric, Novartis, Abbott Laboratories, PepsiCo, ABB, Interactive Brokers, Elevance Health, Volvo, EQT AB, Evolution

Friday July 18

- Data: US July University of Michigan survey, June building permits, housing starts, Japan June national CPI, Germany June PPI, Italy May current account balance, ECB May current account, Eurozone May construction output

- Earnings: American Express, Charles Schwab, Schlumberger, Saab

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

- There are no major economic data releases scheduled.

Tuesday, July 15

- 08:30 AM CPI (MoM), June (GS +0.30%, consensus +0.3%, last +0.1%); Core CPI (MoM), June (GS +0.23%, consensus +0.3%, last +0.1%); CPI (YoY), June (GS +2.68%, consensus +2.6%, last +2.4%); Core CPI (YoY), June (GS +2.93%, consensus +2.9%, last +2.8%): We estimate a 0.23% increase in June core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, unchanged new car prices, and a more moderate increase in the car insurance category (+0.3%) based on premiums in our online dataset. We forecast a modest rebound in airfares in June (+1%), though we see meaningful two-sided risk to this component, reflecting a large headwind from seasonal distortions but a large increase in underlying airfares based on our equity analysts tracking of online price data. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation. We expect the shelter components to rebound slightly on net (primary rent +0.25% vs. +0.21% in May; OER +0.27% vs. +0.27%). We estimate a 0.30% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in June. We will update our core PCE forecast after the CPI is released.

- 08:30 AM Empire State manufacturing survey, July (consensus -9.6, last -16.0)

- 09:15 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give welcoming remarks at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 23rd, Bowman said that she would “support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

- 12:45 PM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on financial inclusion at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 24th, Barr said that “monetary policy is well positioned” to allow the Fed to “wait and see how economic conditions unfold.” He also added that he expects “inflation to rise due to tariffs,” and that higher short-term inflation expectations, supply chain adjustments, and second-round effects may cause “some inflation persistence.”

- 01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver the speech “Forecasting Beyond Today's Data” in Baltimore. He previously gave the same speech on June 26th. Speech text and audience Q&A are expected. On July 2nd, Barkin noted that there is no urgency to adjust policy at the moment, as “the numbers on the economy are very solid.”

- 02:45 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver the closing keynote at the 2025 Economic Measurement Seminar in Washington DC. Speech text is expected. On June 25th, Collins said that she sees “monetary policy as currently well positioned,” and that she favors “a careful, patient, and highly attentive approach” as the implications of tariffs and other changes in government policies are assessed. She also indicated that her baseline outlook is to resume lowering the fed funds rate later in the year.

- 07:45 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks and speak about the economy in an event hosted by the World Affairs Council of San Antonio. Speech text and audience Q&A are expected. On June 2nd, Logan said that risks on both sides of the dual mandate appear “fairly balanced,” leaving the Fed well positioned “to wait for the data” and “to be patient.”

Wednesday, July 16

- 08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the speech “Forecasting Beyond Today's Data” in Westminster, Maryland. Speech text and audience Q&A are expected.

- 08:30 AM PPI final demand, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, June (GS +0.1%, consensus +0.2%, last +0.1%)

- 09:15 AM Industrial production, June (GS flat, consensus +0.1%, last -0.2%): Manufacturing production, June (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, June (GS 77.3%, consensus 77.4%, last 77.4%): We estimate industrial production was unchanged in June, as strong electricity production balanced weak auto production. We estimate capacity utilization declined slightly to 77.3%.

- 09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Corporate College 20th Anniversary Celebration Business Breakfast at Cuyahoga Community College. Speech text is expected. On June 24th, Hammack said that, despite recent progress, the Fed still has “some distance to go” before reaching its inflation target. She indicated that “it may well be the case that policy remains on hold for quite some time before the Committee initiates very modest cuts to return policy to a neutral setting.”

- 10:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at a Brookings event on financial regulation. Speech text and moderated and audience Q&A are expected.

- 02:00 PM Beige Book, July meeting period: The Feds Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity had declined slightly since April, with six districts reporting “slight to moderate declines” in activity, three districts reporting “no change” in activity, and the remaining three districts reporting “slight growth.” It also noted that all districts reported “elevated levels” of economic and policy uncertainty. In line with the previous report, the outlook remained slightly pessimistic and uncertain, as a few districts anticipated a deterioration but a few others anticipated an improvement in economic conditions. In this month's Beige Book, we look for anecdotes related to the evolution of policy uncertainty and firms' expectations for the pass-through of tariff-related costs to consumer prices.

- 05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks on the economic outlook and monetary policy at an event hosted by the New York Association for Business Economics. On June 24th, Williams noted that it is “entirely appropriate” to maintain “a modestly restrictive stance of monetary policy” while assessing the full impact of policy changes on the labor market and inflation. He also indicated that he expects real GDP growth to “slow considerably from last year's pace” as a result of uncertainty, tariffs, and reduced immigration.

Thursday, July 17

- 08:30 AM Retail sales, June (GS flat, consensus +0.1%, last -0.9%); Retail sales ex-auto, June (GS +0.2%, consensus +0.3%, last -0.3%); Retail sales ex-auto & gas, June (GS +0.2%, consensus +0.3%, last -0.1%); Core retail sales, June (GS +0.4%, consensus +0.3%, last +0.4%); We estimate core retail sales increased:0.4% in June (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed measures of card spending but a potential boost from spending around the Juneteenth holiday. We estimate headline retail sales were unchanged, reflecting sharply lower auto sales.

- 08:30 AM Import price index, June (consensus +0.3%, last flat)

- 08:30 AM Initial jobless claims, week ended July 12 (GS 237k, consensus 233k, last 227k): Continuing jobless claims, week ended July 5 (consensus 1,965k, last 1,965k)

- 08:30 AM Philadelphia Fed manufacturing index, July (GS -1.0, consensus -1.0, last -4.0)

- 10:00 AM Business inventories, May (consensus flat, last flat)

- 10:00 AM NAHB housing market index, July (consensus 33, last 32)

- 10:00 AM Fed Governor Adriana Kugler speaks: Fed Governor Adriana Kugler will speak on housing and the US economic outlook at an event hosted by the Housing Partnership Network Symposium. Speech text is expected. On June 5th, Kugler said that she sees “greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road,” leading her to “support maintaining the FOMC's policy rate at its current setting if upside risks to inflation remain.”

- 12:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will appear on Bloomberg TV from the Rocky Mountain Economic Summit in Victor, Idaho. On July 10th, Daly said that she sees two interest rate cuts by the end of the year as “a likely outcome.” She also noted that there is a greater chance that the price effects from tariffs may be more limited than anticipated, as “businesses find ways to adjust” to higher costs.

- 01:30 PM Fed Governor Lisa Cook speaks: Fed Governor Lisa Cook will speak on AI and innovation at the NBER Summer Institute. Speech text and moderated Q&A are expected. On June 3rd, Cook noted that the economy is still in “a solid position” but “heightened uncertainty due to changes in trade policy poses risks to both price stability and unemployment.” She added that “monetary policy will need to carefully balance our dual mandate goals.”

- 06:30 PM Fed Governor Christopher Waller speaks: Fed Governor Christopher Waller will speak on the US economic outlook and monetary policy at the Money Marketeers of NYU. Speech text and moderated and audience Q&A are expected. On July 10th, Waller said that the Fed “could consider cutting the policy rate in July.” He also noted that the Fed should continue shrinking the size of its balance sheet, as bank reserves are currently above an “ample” level. On June 20th, Waller noted that policy had been “on pause for six months to wait and see, and so far the data has been fine.”

Friday, July 18

- 08:30 AM Housing starts, June (GS +2.0%, consensus +3.1%, last -9.8%) ; Building permits, June (consensus -0.5%, last -2.0%)

- 10:00 AM University of Michigan consumer sentiment, July preliminary (GS 61.5, consensus 61.4, last 60.7); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.9%, consensus 4.0%, last 4.0%)

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Son Haberler

ABD'nin petrol sondaj kulesi sayısı azaldı

ABD için resesyon riski düştü

İstanbul kira artışında New York'u bile geride bıraktı

Singapur güçlü büyüdü

Çin'de ihracat arttı

Bundesbank'tan Almanya için korkutan yorum

Kamu işçileri zam alamadı... HAK-İŞ Başkanı: Almadığımız ücretin borçlusu olduk

Kur Hesaplayıcı